hotel tax calculator quebec

Calculate your take-home pay in Quebec. The Canon HS-1200TS may be small in terms of dimensions but this portable desktop calculator is.

What U S Companies Should Know About Selling Goods And Services In Canada

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes.

. The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and Quebec tax brackets. Federal income tax rates in 2022 range from 15. If you make 52000 a year living in the region of quebec canada you will be taxed 15237.

In Quebec the provincial sales tax is called the Quebec. Quebec Basic Personal Amount. Sales Taxes in Quebec.

Your gross to net income in just seconds. Federal Basic Personal Amount. Calculate the total income taxes of a Quebec residents for 2022.

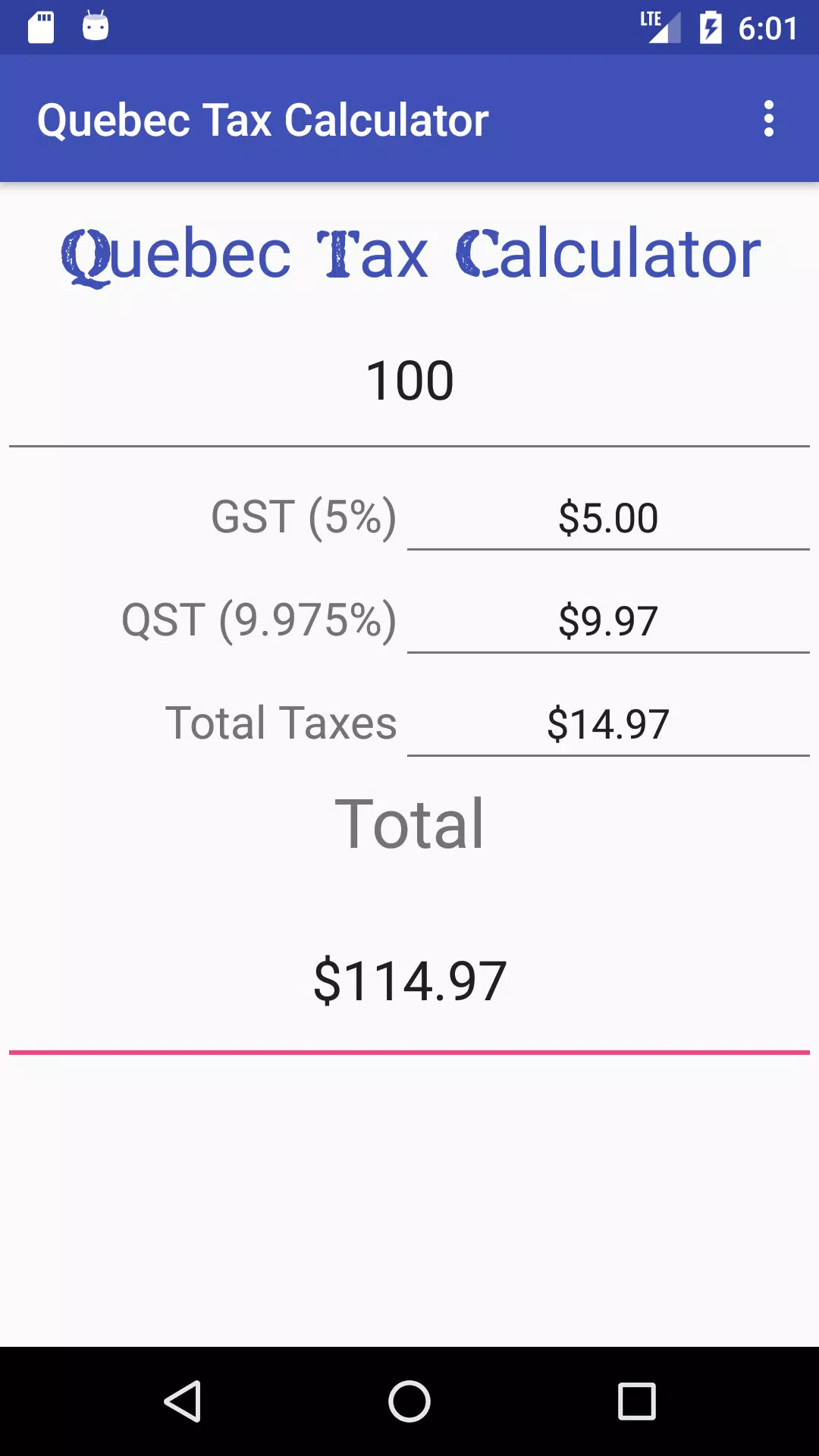

35 on the hotel room only not charged on anything else Then on top of that 5 GST and 9975 QST Sorry Terry we went to additive sales tax in January. The calculator include the net tax income after tax tax return and the percentage of tax. Sales taxes for Quebec residents to other provinces in Canada for 2022.

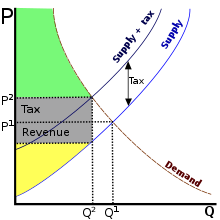

Type of supply learn about what. Quebec Income Tax Calculator. This marginal tax rate means that your immediate additional income will be taxed at.

Quebec Personal Income Tax Brackets and Tax Rates in 2022. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for. So it would be 100 -.

This total rate is a combination of a Goods and Services Tax GST of 5 and a Quebec Sales Tax QST of. Tax in Quebec is determined by the taxable income amount. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Calculator to calculate sales taxes in Quebec. On the written record of the rental you must indicate the 35 tax on lodging in one of. If you make 52000 a year living in the region of quebec canada you will be taxed 15237.

Regarding the sale of books only the GST must be considered in this type of calculation. Tax calculator quebec - Canon Office Canon Office Products HS-1200TS Business Calculator. Age Amount Tax Credit 65.

If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237. Quebec Income Tax Rates. That means that your net pay will be 36763 per year or 3064 per month.

45105 or less is taxed at 15 more than 45105 but not more than. Quebec income tax rates are staying the same for 2021 but the levels of each tax bracket will be increasing. The TIP is at least equal to the.

The cumulative sales tax rate for 2022 in Quebec Canada is 14975. The period of reference or the tax. This marginal tax rate means that your immediate additional income will be taxed at.

The rate you will charge depends on different factors see. The following table provides the GST and HST provincial rates since July 1 2010. Quebec marginal tax rate is another term for tax brackets.

Beware some bars restaurants charge a tip on the amount TTC while it should be calculated on the amount HT. In calculating the tax only fractions of tax equal to or greater than 0005 are rounded off to 001. The Quebec Income Tax Salary Calculator is updated 202223 tax year.

Here is how the total is calculated before sales tax.

Cra Answers Questions On Graduated Rate Estates Investment Executive

Delta Hotels By Marriott Quebec Quebec Qc 690 Boul Rene Levesque East G1r5a8

How To Calculate Taxes On A Lump Sum Sapling

Try Cbc S Stadium Tax Calculator Cbc News

An App To Calculate Sales Taxes In Quebec Hardbacon

Simple Quebec Tax Calculator Apk For Android Download

Canada Requires Non Resident Vendors And Marketplaces To Collect Gst Hst As Of July 1

The Small Business Owners Guide To Provincial Sales Tax

Tax Rates Stripe Documentation

When Is It Safe To Recycle Old Tax Records And Tax Returns

Vermont Sales Tax Calculator Reverse Sales Dremployee

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

4 Ways To Calculate Sales Tax Wikihow

Income Tax Calculator Calculatorscanada Ca

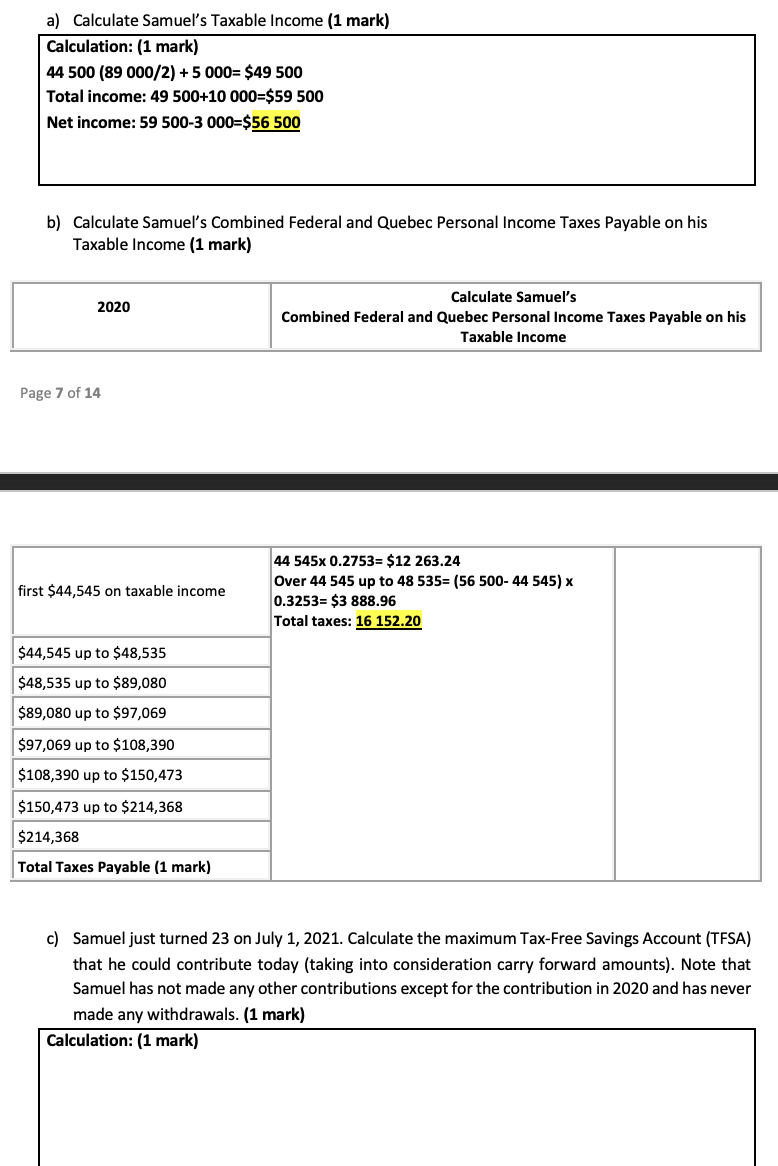

Solved The Year 2020 Was Not An Easy Year For Samuel Who Chegg Com